The following information pertains to questions

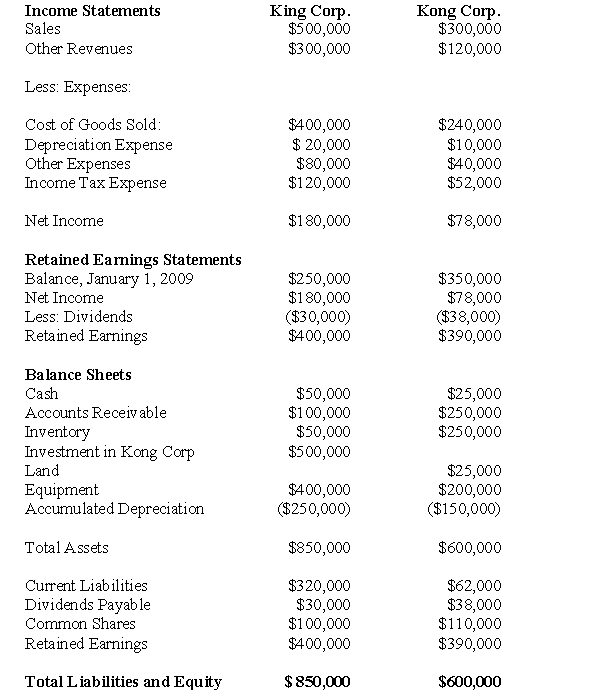

King Corp.owns 80% of Kong Corp and uses the cost method to account for its investment,which it acquired on January 1,2009.The Financial Statements of King Corp and Kong Corp for the Year ended December 31,2009 are shown below:  Other Information:

Other Information:

King sold a tract of Land to Kong at a profit of $10,000 during 2009.This land is still the property of Kong Corp.

On January 1,2009,Kong sold equipment to King at a price that was $20,000 higher than its book value.The equipment had a remaining useful life of 4 years from that date.

On January 1,2009 King's inventories contained items purchased from Kong for $10,000.This entire inventory was sold to outsiders during the year.Also during 2009,King sold Inventory to Kong for $50,000.Half this inventory is still in Kong's warehouse at year end.All sales are priced at a 25% mark-up above cost,regardless of whether the sales are internal or external.

Kong's Retained Earnings on the date of acquisition amounted to $250,000.There have been no changes to the company's common shares account.

Kong's book values did not differ materially from its fair values on the date of acquisition with the following exceptions:

▫ Inventory had a Fair value that was $20,000 higher than its book value.This inventory was sold to outsiders during 2009.

▫ A Patent (which had not previously been accounted for) was identified on the acquisition date with an estimated fair value of $15,000.The patent had an estimated useful life of 3 years.

▫ There was a goodwill impairment loss of $4,000 during 2009.

▫ Both companies are subject to an effective tax rate of 40%.

▫ Both companies use straight line amortization.

-What would be the amount appearing on the December 31,2009 Consolidated Statement of Financial Position for cost of goods sold?

Definitions:

Investing Activities

Transactions involving the purchase or sale of long-term assets and other investments not considered cash equivalents.

Financing Activities

involve transactions related to raising capital and repaying investors, including issuing equity, obtaining loans, and paying dividends.

Direct Method

A cash flow statement preparation approach showing actual cash inflows and outflows from operating activities without adjustments for non-cash transactions.

Operating Activities

Activities that are directly related to the primary operations of the company, including cash inflows and outflows from selling products and services.

Q9: Prepare Alpha's Consolidated Income Statement for the

Q14: Which of the following rates would be

Q18: Which of the following is least likely

Q32: The amount of retained earnings appearing on

Q36: Assuming that Parent Inc.purchased 80% of Sub's

Q49: Gains and losses on fair-value-through-profit-or-loss securities:<br>A)are included

Q54: Consolidated Net Income for 2008 would be:<br>A)$15,000<br>B)$12,500<br>C)$53,200<br>D)$36,300

Q63: Following are the income statements for the

Q92: The incremental cash flow approach:<br>A)Analyzes the additional

Q97: Biases:<br>A)Are issues about which managers have doubts.<br>B)Do