The following information pertains to questions

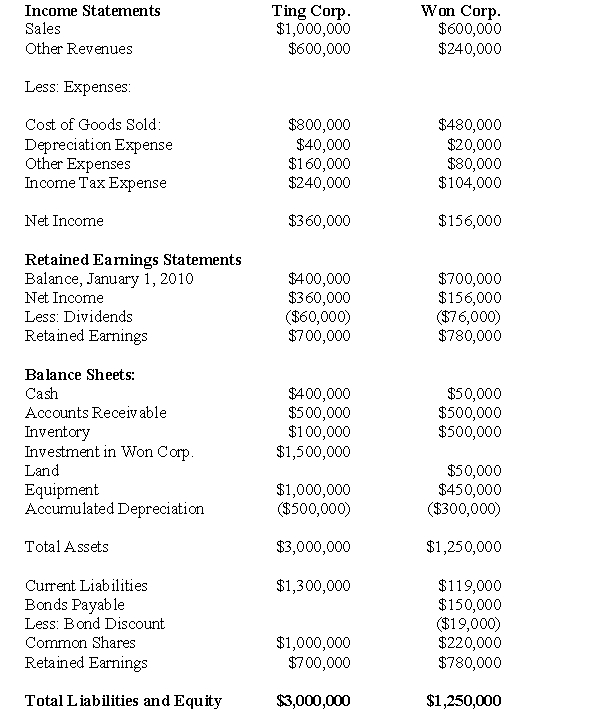

Ting Corp.owns 75% of Won Corp and uses the Cost Method to account for its Investment,which it acquired on January 1,2010 The Financial Statements of Ting Corp and Won Corp for the Year ended December 31,2010 are shown below:  Other Information:

Other Information:

Won sold a tract of land to Ting at a profit of $20,000 during 2010.This land is still the property of Ting Corp.

On January 1,2010,Won sold equipment to Ting at a price that was $20,000 lower than its book value.The equipment had a remaining useful life of 5 years from that date.

On January 1,2010,Won's inventories contained items purchased from Ting for $120,000.This entire inventory was sold to outsiders during the year.Also during 2010,Won sold inventory to Ting for $30,000.Half this inventory is still in Ting's warehouse at year end.All sales are priced at a 20% mark-up above cost,regardless of whether the sales are internal or external.

Won's Retained Earnings on the date of acquisition amounted to $400,000.There have been no changes to the company's common shares account.

Won's book values did not differ materially from its fair values on the date of acquisition with the following exceptions:

▫ Inventory had a fair value that was $50,000 higher than its book value

▫ A patent (which had not previously been accounted for) was identified on the acquisition date with an estimated fair value of $20,000.The patent had an estimated useful life of 5 years.

▫ There was a goodwill impairment loss of $10,000 during 2010

▫ Both companies are subject to an effective tax rate of 40%.

▫ Both companies use straight line amortization exclusively.

▫ On January 1,2010,Ting acquired half of Won's bonds for $60,000

▫ The bonds carry a coupon rate of 10% and mature on January 1,2030.The initial bond issue took place on January 1,2010.The total discount on the issue date of the bonds was $20,000.

▫ Gains and losses from intercompany bondholdings are to be allocated to the two companies when consolidated statements are prepared.

-What would be the non-controlling interest amount appearing on Ting's Consolidated Statement of Financial Position on January 1st,2010?

Definitions:

Intestinal Epithelial Cells

Cells that line the interior surface of the intestines, playing roles in nutrient absorption, secretion, and serving as a barrier to pathogens.

Emulsify Fats

The process of breaking down fats into smaller droplets, typically by the action of bile acids, to make them easier to digest.

Bile Salts

Components of bile, which aid in the digestion and absorption of fats in the small intestine by emulsifying fats.

Micelles

Aggregates of surfactant molecules dispersed in a liquid colloid, forming a structure with a hydrophilic (water-attracting) exterior and a hydrophobic (water-repelling) core.

Q3: Consolidated Shareholder Equity<br>A)includes any Non-Controlling Interest.<br>B)is equal

Q11: What is the TOTAL amount of CMI's

Q18: Which of the following is least likely

Q20: Assuming that Davis purchases 80% of Martin

Q20: Excluding any goodwill impairment losses,what would be

Q30: Clustering is a task that should be

Q35: The calculation of Goodwill and Non-Controlling Interest

Q56: What would be the balance in the

Q96: Uncertainty may hinder a manager's ability to:<br>I.

Q102: Strawser Company is developing a cost function