The following information pertains to questions

X Inc.owns 80% of Y Inc.During 2009,X Inc sold inventory to Y for $10,000.Half of this inventory remained in Y's warehouse at year end.Half of this inventory remained in Y's warehouse at year end.Also during 2009,Y Inc sold Inventory to X Inc.for $5,000.40% of this inventory remained in X's warehouse at year end.Both companies are subject to a tax rate of 50%.The gross profit percentage on sales is 20% for both companies.Unless otherwise stated,assume X Inc.uses the cost method to account for its Investment in Y.Inc.

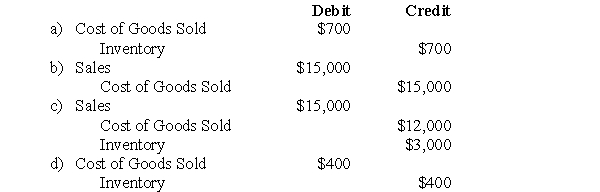

-What would be the journal entry to eliminate any unrealized profits from the Consolidated Financial Statements during the year?

Definitions:

Articles Of Incorporation

Legal documents filed with a state government to officially form a corporation.

Revised Model Business Corporation Act

An updated framework designed to guide the formation, operation, and governance of corporations, aiming to standardize business practices across states.

Registered Office

The official address of a corporation or company, where legal documents are sent and statutory records are kept.

Promoter

An individual or company responsible for organizing, marketing, and often financing a project or venture, especially in the entertainment industry or in founding a corporation.

Q1: What is the after-tax dollar value of

Q2: Certain clothing is always inappropriate for the

Q8: What is the amount of the Deferred

Q24: How much Goodwill was amortized during 2003?<br>A)$700<br>B)($1,700)<br>C)$1,700<br>D)None

Q27: What writing pattern does this paragraph employ?<br>A)

Q34: On January 1,2002,Jonson Inc.paid $400,000 to purchase

Q44: Accounting information is used to monitor operations

Q51: Which of the following statements is correct?<br>A)In

Q68: Organizational core competencies can include:<br>A)A mission statement<br>B)Patents,

Q81: Which of the following is not true