The following information pertains to questions

MAX Inc.purchased 80% of the voting shares of MIN Inc for $750,000 on January 1,2007.On that date,MAX's common stock and retained earnings were valued at $300,000 and $150,000 respectively.Unless otherwise stated,assume that MAX uses the cost method to account for its investment in MIN Inc.

MIN's fair values approximated its carrying values with the following exceptions:

MIN's trademark had a fair value which was $80,000 higher than its carrying value.

MIN's bonds payable had a fair value which was $30,000 higher than their carrying value.

The trademark had a useful life of exactly twenty years remaining from the date of acquisition.The bonds payable mature on January 1,2020.Both companies use straight line amortization exclusively.

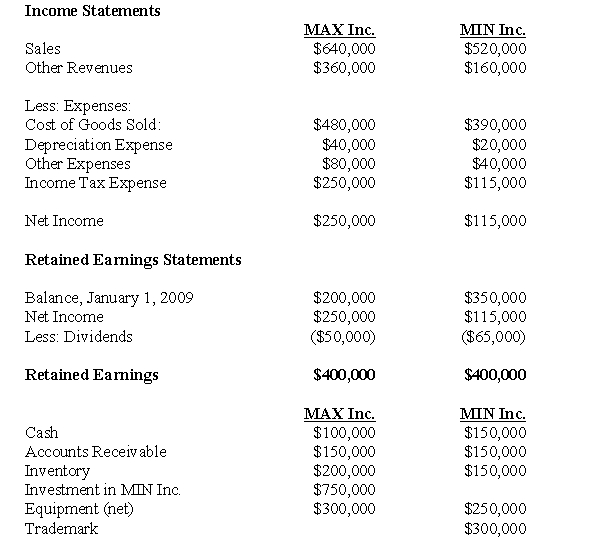

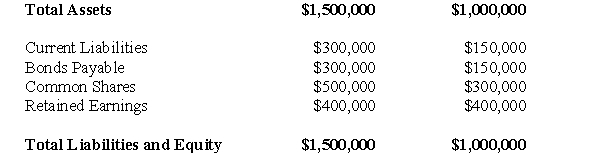

The Financial Statements of both companies for the Year ended December 31,2009 are shown below:

Other Information:

Other Information:

A goodwill impairment test conducted during August of 2009 revealed that the Min's goodwill amount on the date of acquisition was overstated by $5,000.

During 2008,Max sold $60,000 worth of Inventory to Min,80% of which was sold to outsiders during the year.During 2009,Max sold inventory to Min for $80,000.75% of this inventory was resold by Min to outside parties.

During 2008,Min sold $40,000 worth of Inventory to Max,80% of which was sold to outsiders during the year.During 2009,Min sold inventory to Max for $50,000.80% of this inventory was resold by Max to outside parties.

All intercompany sales as well as sales to outsiders are priced 25% above cost.The effective tax rate for both companies is 50%.

-Prepare a schedule of Realized and Unrealized profits for 2009 for both companies.Show your figures before and after tax.

Definitions:

Repetitive Activities

Actions or tasks that are performed in a similar manner on a regular basis.

Leadership Development

Programs or activities designed to enhance the leadership skills and abilities of individuals within an organization to better meet future challenges and lead teams effectively.

Orientation

The process of introducing new employees to their job, colleagues, and the organization, providing them with necessary information to start working.

Succession Management

The process of identifying and developing internal personnel with the potential to fill key leadership positions within the organization.

Q2: One common criticism of the Purchase Method

Q3: George Peterson is the President of Alpha

Q7: What is the amount of miscellaneous liabilities

Q7: When the Non-Controlling Interest's share of the

Q19: A not-for-profit organization is required to record

Q20: What writing pattern does this paragraph employ?<br>A)

Q26: Subject: planting a tree <br>Audience: _<br>Purpose: to

Q34: Accounting policies created in countries governed by

Q42: What is the amount of the amortization

Q47: Which of the following statements regarding organizational