The following information pertains to questions

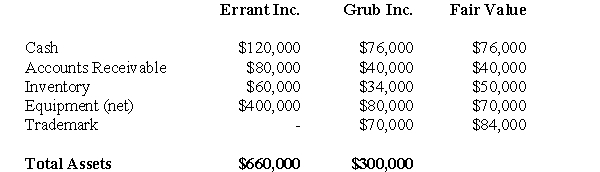

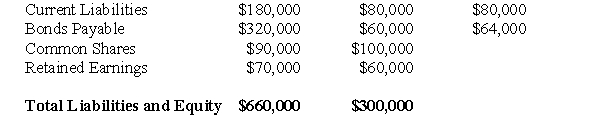

Errant Inc purchased 100% of the outstanding voting shares of Grub Inc.for $200,000 on January 1,2004.On that date,Grub Inc had common stock and retained earnings worth $100,000 and $60,000,respectively.Goodwill is tested annually for impairment.The Balance Sheets of both companies,as well as Grub's fair market values on the date of acquisition are disclosed below:

The net incomes for Errant and Grub for the year ended December 31,2007 were $160,000 and $90,000 respectively.Grub paid $9,000 in Dividends to Errant during the year.There were no other inter-company transactions during the year.Moreover,an impairment test conducted on December 31,2007 revealed that the Goodwill should actually have a value of $20,000.Both companies use a FIFO system,and most of Grub's inventory on the date of acquisition was sold during the year.Errant did not declare any dividends during the year.

The net incomes for Errant and Grub for the year ended December 31,2007 were $160,000 and $90,000 respectively.Grub paid $9,000 in Dividends to Errant during the year.There were no other inter-company transactions during the year.Moreover,an impairment test conducted on December 31,2007 revealed that the Goodwill should actually have a value of $20,000.Both companies use a FIFO system,and most of Grub's inventory on the date of acquisition was sold during the year.Errant did not declare any dividends during the year.

Assume that Errant Inc.uses the Equity Method unless stated otherwise.

-The amount of Retained Earnings appearing on the Consolidated Balance Sheet as at January 1,2007 would be:

Definitions:

Machine-Hours

A unit of measure representing the operation of machinery over time, typically used for allocating manufacturing overhead costs.

Predetermined Overhead Rate

A rate calculated at the beginning of a period for allocating estimated overhead costs to cost objects based on a chosen activity base.

Machine-Hours

This refers to the total number of hours that machinery is in operation, used as a basis for allocating manufacturing overhead to products.

Predetermined Overhead Rate

A rate used to allocate manufacturing overhead costs to products or job orders, calculated before the period begins based on estimated overhead and activity levels.

Q4: The prewriting above is<br>A) focused freewriting.<br>B) brainstorming.<br>C)

Q17: Which of the following journal entries would

Q18: What would be the gain or loss

Q27: Assume that Stanton had other Intangible assets

Q32: Which of the following rates would be

Q41: What effect (if any)would Hanson's January 1,2010

Q42: How would any management fees charged by

Q51: For a self-sustaining foreign operation,exchange gains and

Q111: Which of the following adjectives describes higher

Q114: What two things are being compared and/or