The following information pertains to questions

Big Guy Inc.purchased 80% of the outstanding voting shares of Humble Corp.for $360,000 on July 1,2001.On that date,Humble Corp had Common Stock and Retained Earnings worth $180,000 and $90,000,respectively.The Equipment had a remaining useful life of 5 years from the date of acquisition.Humble's Bonds mature on July 1,2011.Both companies use straight line amortization,and no salvage value is assumed for assets.The trademark is assumed to have an indefinite useful life.

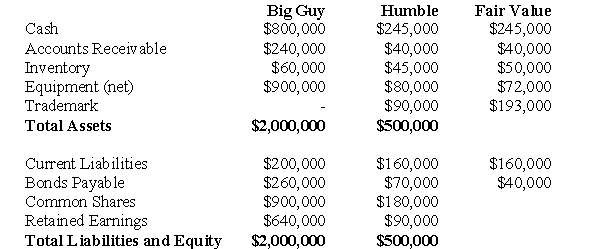

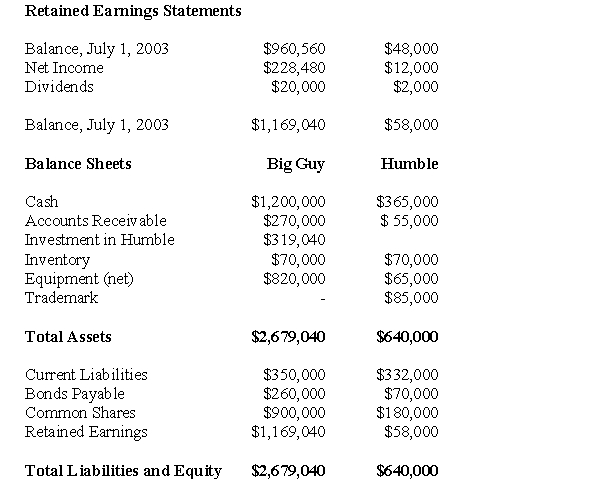

Goodwill is tested annually for impairment.The Balance Sheets of Both Companies,as well as Humble's Fair Market Values on the date of acquisition are disclosed below:  The following are the Financial Statements for both companies for the fiscal year ended July 1,2004:

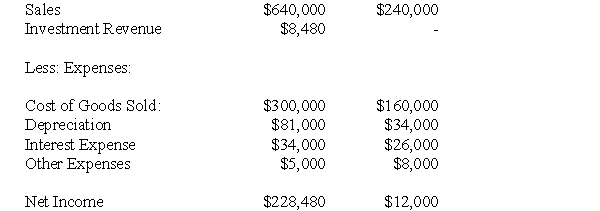

The following are the Financial Statements for both companies for the fiscal year ended July 1,2004:

Income Statements:

An impairment test conducted in September 2002 on Big Guy's goodwill resulted in an impairment loss of $10,000 being recorded) Both companies use a FIFO system,and Humble's entire inventory on the date of acquisition was sold during the following year.During 2004,Humble Inc borrowed $20,000 in Cash from Big Guy Inc.interest free to finance its operations.Big Guy uses the Equity Method to account for its investment in Humble Corp.Assume that the entity method applies.

An impairment test conducted in September 2002 on Big Guy's goodwill resulted in an impairment loss of $10,000 being recorded) Both companies use a FIFO system,and Humble's entire inventory on the date of acquisition was sold during the following year.During 2004,Humble Inc borrowed $20,000 in Cash from Big Guy Inc.interest free to finance its operations.Big Guy uses the Equity Method to account for its investment in Humble Corp.Assume that the entity method applies.

-The amount of goodwill appearing on Big Guy's Consolidated Balance Sheet as at July 1,2004 would be:

Definitions:

Normal Interpretation

The process of understanding or explaining something according to a standard or expected pattern, often used in the context of test results or data analysis.

Maximum Number

The highest amount or level that can be achieved or recorded.

Genetic Counseling

A service that provides information and support to individuals or families who have genetic disorders or may be at risk for inherited conditions.

Hereditary Disease

A disease or disorder that is passed from generation to generation through genes.

Q1: Prepare Jean Inc's consolidated Balance Sheet on

Q4: Which paragraph is the conclusion of the

Q12: Which of the following is NOT a

Q17: Zen Inc.owns 35% of Sun Inc's voting

Q24: The risk exposure resulting from the translation

Q33: The amount of goodwill arising from this

Q37: What is the total amount of sales

Q39: I want to become a nurse for

Q49: Prepare a Balance Sheet for Clarke on

Q70: What is the amount of goodwill arising