The following information pertains to questions

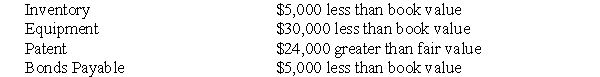

Brand X Inc.purchased a controlling interest in Brand Y Inc.for $200,000 on January 1,2001.On that date,Brand Y Inc had common stock and retained earnings worth $180,000 and $20,000,respectively.Goodwill is tested annually for impairment.At the date of acquisition,Brand Y's assets and liabilities were assessed for fair value as follows:  The Balance Sheets of Both Companies,as at December 31,2001 are disclosed below:

The Balance Sheets of Both Companies,as at December 31,2001 are disclosed below:  The net incomes for Brand X and Brand Y for the year ended December 31,2001 were $1,000 $48,000 respectively.An impairment test conducted on December 31,2001 revealed that the Goodwill should actually have a value $2,000 lower than the amount computed on the date of acquisition.Both companies use a FIFO system,and Brand Y's inventory on the date of acquisition was sold during the year.Brand X did not declare any dividends during the year.However,Brand Y paid $51,000 in dividends to make up for several years in which the company had never paid any dividends.Brand Y's equipment and patent have useful lives of 10 years and 6 years respectively from the date of acquisition.All bonds payable mature on January 1,2006.

The net incomes for Brand X and Brand Y for the year ended December 31,2001 were $1,000 $48,000 respectively.An impairment test conducted on December 31,2001 revealed that the Goodwill should actually have a value $2,000 lower than the amount computed on the date of acquisition.Both companies use a FIFO system,and Brand Y's inventory on the date of acquisition was sold during the year.Brand X did not declare any dividends during the year.However,Brand Y paid $51,000 in dividends to make up for several years in which the company had never paid any dividends.Brand Y's equipment and patent have useful lives of 10 years and 6 years respectively from the date of acquisition.All bonds payable mature on January 1,2006.

-Prepare Brand X's Consolidated Balance Sheet as at December 31,2001,assuming that Brand X purchased 80% of Brand Y for $350,000.Assume the Entity Method is applied)

Definitions:

1930s

A decade marked by the global economic downturn known as the Great Depression, significant political changes, and the lead up to World War II.

Presidential Campaigns

The process by which candidates for the presidency of a country promote themselves and their policies to the electorate to win votes.

Barack Obama

The 44th President of the United States, serving from 2009 to 2017, and the first African American to hold the office.

Donald Trump

The 45th President of the United States, known for his business background and controversial presidency.

Q4: This paragraph will be about my family.<br>A)

Q19: Which of the following sentences does NOT

Q29: Assuming that Hanson had no recorded goodwill

Q33: Below is a plan for a comparison

Q36: What would be the journal entry to

Q38: The subject of this paragraph is<br>A) how

Q40: Assume once again that Keen Purchases 100%

Q46: What is the carrying value of the

Q51: Which sentence is the topic sentence of

Q68: Company A has made an offer to