The following information pertains to questions

Big Guy Inc.purchased 80% of the outstanding voting shares of Humble Corp.for $360,000 on July 1,2001.On that date,Humble Corp had Common Stock and Retained Earnings worth $180,000 and $90,000,respectively.The Equipment had a remaining useful life of 5 years from the date of acquisition.Humble's Bonds mature on July 1,2011.Both companies use straight line amortization,and no salvage value is assumed for assets.The trademark is assumed to have an indefinite useful life.

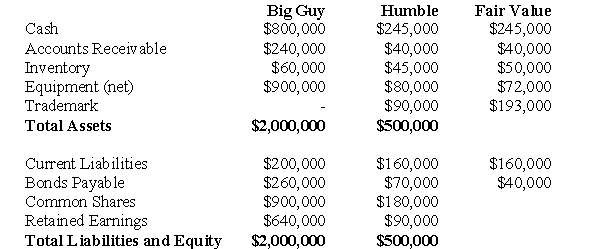

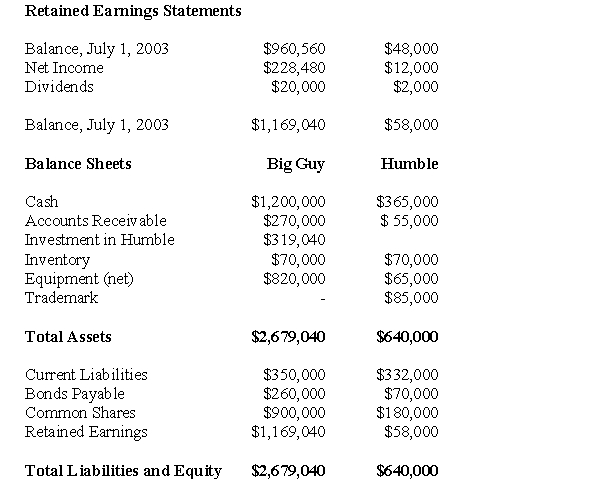

Goodwill is tested annually for impairment.The Balance Sheets of Both Companies,as well as Humble's Fair Market Values on the date of acquisition are disclosed below:  The following are the Financial Statements for both companies for the fiscal year ended July 1,2004:

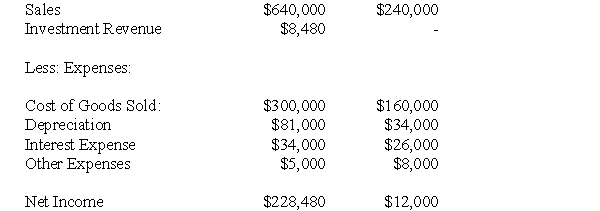

The following are the Financial Statements for both companies for the fiscal year ended July 1,2004:

Income Statements:

An impairment test conducted in September 2002 on Big Guy's goodwill resulted in an impairment loss of $10,000 being recorded) Both companies use a FIFO system,and Humble's entire inventory on the date of acquisition was sold during the following year.During 2004,Humble Inc borrowed $20,000 in Cash from Big Guy Inc.interest free to finance its operations.Big Guy uses the Equity Method to account for its investment in Humble Corp.Assume that the entity method applies.

An impairment test conducted in September 2002 on Big Guy's goodwill resulted in an impairment loss of $10,000 being recorded) Both companies use a FIFO system,and Humble's entire inventory on the date of acquisition was sold during the following year.During 2004,Humble Inc borrowed $20,000 in Cash from Big Guy Inc.interest free to finance its operations.Big Guy uses the Equity Method to account for its investment in Humble Corp.Assume that the entity method applies.

-The amount of goodwill appearing on Big Guy's Consolidated Balance Sheet as at July 1,2004 would be:

Definitions:

Group Density

The degree to which members of a group are physically or socially close to one another.

Network Position

Refers to the specific location or role of an individual or an entity within a network, defining their level of influence, connectivity, and access to resources.

Satisfaction

The feeling of contentment or fulfillment obtained from achieving one's desires, expectations, or needs.

Decentralized Network

A network structure characterized by the distribution of resources and decision-making authority among all members rather than a central authority.

Q7: Prepare journal entries for these transactions,using the

Q9: XYZ Inc.owns 55% of DEF's 100,000 outstanding

Q10: Prepare Jean Inc's consolidated Balance Sheet on

Q12: What is the Consolidated Net Income for

Q14: For each pair of sentences, select the

Q15: Under the Current Rate Method:<br>A)Transaction exposure is

Q21: Fraudulent financial reporting:<br>I. Is an example of

Q64: Strategic cost management focuses on all of

Q68: Company A has made an offer to

Q71: _<br>A) Batboys work very long hours and