The following information pertains to Questions

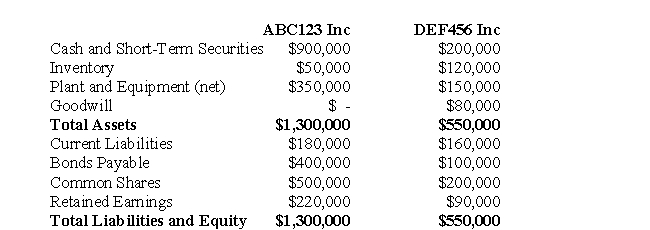

ABC123 Inc has decided to purchase 100% the voting shares of DEF456 for $400,000 in Cash on July1,2008.On the date,the balance sheets of each of these companies were as follows:  On that date,the fair values of DEF456 Assets and Liabilities were as follows:

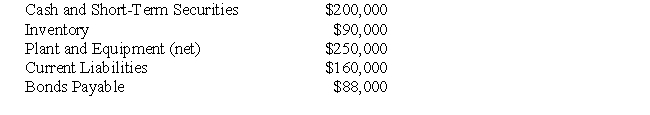

On that date,the fair values of DEF456 Assets and Liabilities were as follows:  In addition to the above,an independent appraiser deemed that DEF456 Inc.had trademarks with a fair market value of $100,000 which had not been accounted for.In turn,ABC123's fair market values were equal to their book values with the exception of the Company's Inventory and Plant and Equipment,which were said to have Fair Market Values of $30,000 and $480,000,respectively.

In addition to the above,an independent appraiser deemed that DEF456 Inc.had trademarks with a fair market value of $100,000 which had not been accounted for.In turn,ABC123's fair market values were equal to their book values with the exception of the Company's Inventory and Plant and Equipment,which were said to have Fair Market Values of $30,000 and $480,000,respectively.

-Prepare any disclosure required for ABC123 Inc.under IFRS.Assume DEF456 produces high-end loudspeakers for touring musicians.

Definitions:

Collective Bargaining Agreement

A written contract between an employer and a labor union representing a group of employees, outlining the terms of employment.

Debtor

A party that owes money to another party.

Rejected

Declined or dismissed, often referring to something that does not meet a certain standard or requirement.

Reorganization

A process aimed at restructuring a company's operations, structures, and finances to increase efficiency and profitability, often used in bankruptcy contexts.

Q2: In our filmmaking class, we are discussing

Q15: Which of the following is/are LEAST likely

Q19: Income-smoothing has been applied to a German

Q21: Contingent consideration will be classified as a

Q21: For each pair of sentences, select the

Q32: A negative acquisition differential<br>A)is always equal to

Q38: What would be the amount of the

Q46: _<br>A) We tried on silk jackets that

Q69: Which of the following methods is the

Q70: What is the amount of goodwill arising