Essay

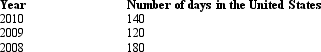

Given the following information,determine whether Greta,an alien,is a U.S.resident for 2010.Assume that Greta cannot establish a tax home in or a closer connection to a foreign country.

Definitions:

Related Questions

Q2: Research by Marciukaityte, Roskelley, and Wang found:<br>A)Positive

Q7: Which of the following is a way

Q11: In risk arbitrage the following is true:<br>A)Investors

Q19: In a Type B Reorganization, the stock

Q26: Properties determine the visual appearance of a

Q26: Austin,Inc. ,a domestic corporation,generates U.S.-source and foreign-source

Q67: Hummingbird Corporation has 1,000 shares of common

Q76: What are the tax consequences of a

Q93: Ira,a calendar year taxpayer,purchases as an investment

Q119: Which of the following statements regarding foreign