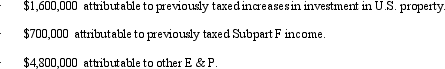

Benchmark,Inc. ,a U.S.shareholder owns 100% of a CFC from which Benchmark receives a $3 million cash distribution.The CFC's E & P is composed of the following amounts.

Benchmark recognizes a taxable dividend of:

Definitions:

Fixed Costs

Fixed costs are business expenses that remain constant regardless of the level of production or sales, such as rent or salaries.

Specialization

A production strategy where individuals, regions, or nations focus on the production of a limited scope of goods or services to gain greater efficiency and productivity.

Economies of Scale

Economies of Scale describe the cost advantages that a business can achieve due to expansion, leading to a lower cost per unit of output.

Long-run Average Total Costs

The per-unit production cost when all factors of production are variable and optimized for scale.

Q6: One of the advantages of an asset

Q7: ParentCo and SubCo have filed consolidated returns

Q14: USCo,a domestic corporation,receives $100,000 of foreign-source income

Q20: Renee,the sole shareholder of Indigo Corporation,sold her

Q23: The most common form of secondary storage

Q36: On January 1,Gull Corporation (a calendar year

Q59: Which of the following statements regarding the

Q61: Dividends taxed at a 15% rate are

Q75: North Corporation acquires 90% of South's assets

Q79: A shareholder's holding period of property acquired