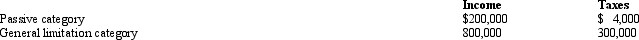

BendCo,Inc. ,a U.S.corporation,has foreign-source income and pays foreign taxes as follows.

BendCo's worldwide taxable income is $1,600,000 and U.S.taxes before FTC are $560,000 (assume 35%).What is BendCo's U.S.tax liability after the FTC?

Definitions:

Visual Learner

An individual who understands and retains information better when it is presented visually, such as through diagrams or videos.

Poetry Course

A program of study focusing on the understanding, analysis, and composition of poetry, exploring various styles and historical contexts.

Comprehension Skills

The ability to understand, process, and interpret written or spoken information.

English Words

Linguistic units of the English language used to convey meaning, consisting of vowels and consonants formed into meaningful sequences.

Q3: The tender offer was first introduced in

Q7: ParentCo and SubCo have filed consolidated returns

Q18: Roll-ups were not common in the 1990s

Q23: FLCo,a U.S.corporation,has $250,000 interest expense for the

Q24: Red Corporation,a calendar year taxpayer,has taxable income

Q42: Which of the following is eligible to

Q65: Without the foreign tax credit,double taxation would

Q75: The U.S.states apply different rules in treating

Q107: Amelia,Inc. ,a domestic corporation,has worldwide taxable income

Q124: Tax deferred reorganizations involving U.S.-owned foreign corporations