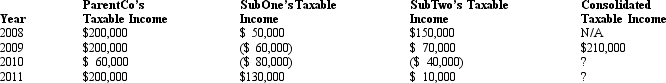

ParentCo,SubOne and SubTwo have filed consolidated returns since 2009.All of the entities were incorporated in 2008.Taxable income computations for the members include the following.None of the group members incurred any capital gain or loss transactions during these years,nor did they make any charitable contributions.

How should the 2010 consolidated net operating loss be apportioned among the group members?

ParentCo SubOne SubTwo

Definitions:

Intertemporal Price Discrimination

A pricing strategy where a seller changes prices over time for the same product or service to maximize profits by taking advantage of differences in consumers' willingness to pay at different times.

Marginal Cost

The growth in the overall expense incurred from producing an additional unit.

Economies of Scale

The cost advantages that enterprises obtain due to their scale of operation, resulting in decreased costs per unit.

Perfect Competition

A market structure characterized by many buyers and sellers, homogenous products, no barriers to entry, and perfect information.

Q5: Legal dissolution under state law is not

Q16: Madison is a citizen of Italy and

Q16: Burl Corporation has assets with a value

Q16: In a de facto merger:<br>A)Bidders may be

Q36: Gravity Corporation creates Earth Corporation.It transfers most

Q39: What tax accounting period and methods must

Q73: Adam transfers inventory with an adjusted basis

Q87: Which reason is unlikely to cause a

Q103: Three years ago,Darlene received preferred (§ 306)stock

Q133: Sang,an NRA who was not a resident