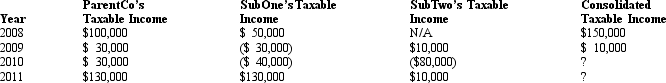

ParentCo and SubOne have filed consolidated returns since 2006.SubTwo was formed in 2010 through an asset spin-off from ParentCo.SubTwo has joined in the filing of consolidated returns since then.Taxable income computations for the members include the following.None of the group members incurred any capital gain or loss transactions during these years,nor did they make any charitable contributions.

If ParentCo does not elect to forgo the carryback of the 2010 net operating loss,what portion of the 2010 consolidated net operating loss is carried back to offset prior years' income?

Definitions:

Local Control

The autonomy granted to local authorities or units within an organization to make decisions and manage affairs independently.

Foreign Country Control

The influence or governance by a foreign power over another country's decisions or policies, often in economic contexts.

Geocentric

An approach in international business where company strategies are applied globally without adjusting for local conditions, viewing the world as a potential market.

International Operations

Business activities and engagements that a company conducts beyond its domestic borders, involving trade, manufacturing, or services in foreign countries.

Q1: Which of the following are examples of

Q4: During the current year,Goldfinch Corporation purchased 100%

Q5: Legal dissolution under state law is not

Q7: Joe owns 100% of Green Corporation (E

Q8: With a divisive "Type D" reorganization,two corporations

Q14: Bange and Mazzeo found that target companies

Q16: Madison is a citizen of Italy and

Q30: Which one of the following statements is

Q76: The losses of a consolidated group member

Q93: The AMT NOL deduction is limited to