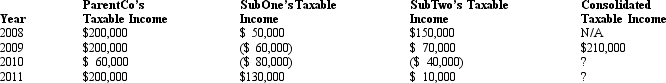

ParentCo,SubOne and SubTwo have filed consolidated returns since 2009.All of the entities were incorporated in 2008.Taxable income computations for the members include the following.None of the group members incurred any capital gain or loss transactions during these years,nor did they make any charitable contributions.

How should the 2010 consolidated net operating loss be apportioned among the group members?

ParentCo SubOne SubTwo

Definitions:

Laspeyres Price Index

A price index used to measure the change in the cost of purchasing a fixed basket of goods and services over time, based on the quantities purchased in the base period.

Consumption Bundle

A set of goods or services that an individual or household chooses to consume within a given period, reflecting their preferences and budget constraint.

Prices

Monetary values assigned to goods and services, determining what amount of money is needed to purchase them.

Laspeyres Price Index

A measure of the change in the aggregate price level of a basket of goods and services over time, using the quantities purchased in the base year.

Q5: In August,Sunglow Corporation declares a $4 dividend

Q17: Sarah and Emily form Red Corporation with

Q17: In the United States when a bidder

Q38: Wendy and David,equal shareholders in Loon Corporation,receive

Q40: Sam's gross estate includes stock in Tern

Q69: A "U.S.shareholder" for purposes of CFC classification

Q89: A shareholder contributes land to his wholly

Q98: Which of the following statements regarding translation

Q98: Cocoa Corporation is acquiring Milk Corporation in

Q103: Three years ago,Darlene received preferred (§ 306)stock