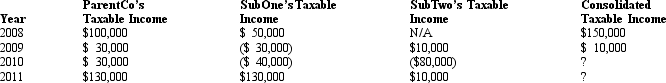

ParentCo and SubOne have filed consolidated returns since 2006.SubTwo was formed in 2010 through an asset spin-off from ParentCo.SubTwo has joined in the filing of consolidated returns since then.Taxable income computations for the members include the following.None of the group members incurred any capital gain or loss transactions during these years,nor did they make any charitable contributions.

If ParentCo does not elect to forgo the carryback of the 2010 net operating loss,what portion of the 2010 consolidated net operating loss is carried back to offset prior years' income?

Definitions:

Ethological Theory

A perspective in psychology that emphasizes the genetic and evolutionary mechanisms behind behaviors and how they contribute to survival.

Biological Basis

The foundation of behaviors, abilities, or diseases in genetic, neurological, or physiological processes within the body.

Skinnerian

Relating to the theories of B.F. Skinner, emphasizing behaviorism and the use of reinforcement to modify behavior.

Aggressive Behavior

Actions intended to cause harm or pain to others, often driven by anger or hostility.

Q3: In Chapter 11, when an automatic stay

Q7: Joe owns 100% of Green Corporation (E

Q17: For purposes of the application of §

Q18: Which reorganization is most likely to run

Q19: The research of Bebchuk and Cohen found

Q52: A shareholder's basis in property received in

Q61: DPAD for 2010 is 9% of the

Q80: The U.S.system for taxing income earned inside

Q93: Carlos purchased 20% of Target Corporation's stock

Q97: Tuna Corporation is very interested in acquiring