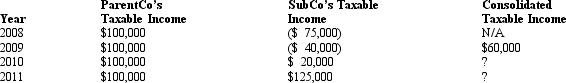

ParentCo purchased all of the stock of SubCo on January 2,2009,and the two companies filed consolidated returns for 2009 and thereafter.Both entities were incorporated in 2008.Taxable income computations for the members include the following.Neither group member incurred any capital gain or loss transactions during these years,nor did they make any charitable contributions.No § 382 limit applies.

To what extent can SubCo's 2008 losses be used by the group in 2011?

Definitions:

Pressure Ulcer

A localized injury to the skin and/or underlying tissue, usually over a bony prominence, caused by pressure or pressure in combination with shear.

Anatomical Location

A term used to describe a specific location or position within the body or one of its parts.

Lesion Depth

The measurement of how deep a wound, sore, or damaged area extends beneath the surface of the skin or organ.

Furuncle

A painful, pus-filled bump under the skin caused by a bacterial infection, commonly known as a boil.

Q8: Research by Roach showed:<br>A)Merger premiums have risen

Q20: The United Technologies takeover of Otis Elevator

Q31: One of the tenets of U.S.tax policy

Q37: Cardinal Corporation has 1,000 shares of common

Q73: Which of the following is a correct

Q82: Boat Corporation manufactures an exercise machine at

Q84: Lark City donates land worth $300,000 and

Q98: In a corporate liquidation governed by §

Q114: Which of the following statements regarding the

Q149: ForCo,a foreign corporation,receives interest income of $50,000