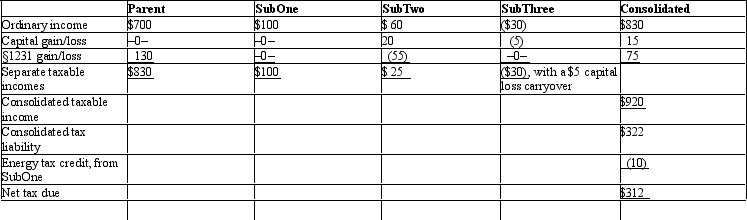

The Parent consolidated group reports the following results for the tax year.Determine each member's share of the consolidated tax liability,assuming that the members all have consented to use the relative taxable income tax-sharing method.Dollar amounts are listed in millions,and a 35% marginal income tax rate applies.

Definitions:

International Expansion

The process by which a business grows beyond its home country, entering new markets globally.

Employment Practices

Policies and practices related to the management of individuals in a workplace setting, including hiring, training, evaluating, and terminating employees.

North American Free Trade Agreement

A trade agreement between Canada, Mexico, and the United States aimed at reducing trade barriers and promoting economic integration.

General Agreement on Tariffs and Trade

An international treaty aimed at reducing trade barriers and promoting global economic trade.

Q12: Which of the following is true of

Q14: Bange and Mazzeo found that target companies

Q16: Penny,Miesha,and Sabrina transfer property to Owl Corporation

Q16: In a de facto merger:<br>A)Bidders may be

Q26: Austin,Inc. ,a domestic corporation,generates U.S.-source and foreign-source

Q31: In the case of an individual,modified AGI

Q80: The U.S.system for taxing income earned inside

Q108: Interest paid to an unrelated party by

Q123: ForCo,a foreign corporation,receives interest income of $100,000

Q140: All of an NRA's U.S.-source income that