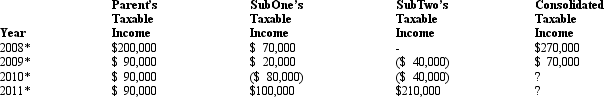

The group of Parent Corporation,SubOne,and SubTwo has filed a consolidated return since 2009.The first two entities were incorporated in 2008,and SubTwo came into existence in 2009 through an asset spin-off from Parent.Taxable income computations for the members are shown below.None of the group members incurred any capital gain or loss transactions during 2008-2011,nor did they make any charitable contributions.

Describe the treatment of the group's 2010 consolidated NOL.Hint: Apply the offspring rule.

* Consolidated return year.

Definitions:

Critical Attitude

An approach characterized by active questioning and skepticism towards texts, policies, and normative practices, aiming to uncover underlying assumptions.

Unscientific Thinking

Reasoning or beliefs not based on systematic methods, empirical evidence, or the scientific method, often encompassing superstitions or anecdotal evidence.

Mystification

The process of obscuring the true nature of situations, relationships, or social conditions, often to preserve power dynamics or prevent scrutiny.

Premature Closure

The cognitive error of coming to a decision or conclusion before all relevant information has been considered or all options have been evaluated.

Q1: Eileen transfers property worth $200,000 (basis of

Q4: Which of the following is not an

Q10: Witmore's research implied that the Asquith et

Q15: Antitakeover defense became increasingly sophisticated during the

Q21: Which statement is false?<br>A)The starting point for

Q24: Four individuals form Chickadee Corporation under §

Q28: To determine E & P,some (but not

Q61: Which of the following is eligible to

Q75: Maria Corporation manufactures and sells ceramic dinnerware.The

Q107: List three "intercompany transactions" of a Federal