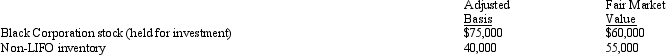

In the current year,Verdigris Corporation (with E & P of $250,000) made the following property distributions to its shareholders (all corporations) :

Verdigris Corporation is not a member of a controlled group.As a result of the distribution:

Definitions:

LIFO

"Last In, First Out", an inventory costing method where the most recently produced or acquired items are recorded as sold first.

FIFO

An inventory valuation method where the first items placed into inventory are the first ones sold; stands for First-In, First-Out.

Inventory Costing

The method used to assign costs to inventory, affecting the cost of goods sold and ending inventory valuations.

Ending Inventory

The total value of all inventory that a company has in stock at the end of an accounting period.

Q15: When a trust distributes an in-kind asset

Q33: Since the § 382 limitation is an

Q34: ParentCo's separate taxable income was $200,000,and SubCo's

Q52: Which of the following items will be

Q56: Cardinal Corporation redeems all of its voting

Q60: ForCo,a controlled foreign corporation owned 100% by

Q61: A trust might be used by a

Q72: Any recapture of special use valuation estate

Q83: The receipt of nonqualified preferred stock in

Q115: A joint venture,taxed like a partnership,can join