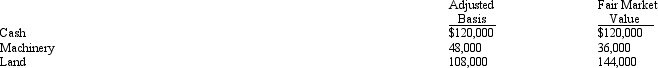

Hazel transferred the following assets to Starling Corporation.

In exchange,Hazel received 50% of Starling Corporation's only class of stock outstanding.The stock has no established value.However,all parties sincerely believe that the value of the stock Hazel received is the equivalent of the value of the assets she transferred.The only other shareholder,Rick,formed Starling Corporation five years ago.

Definitions:

Q6: Under proper circumstances,a disclaimer by an heir

Q16: Christopher makes a gift of securities (basis

Q18: Which statement is false?<br>A)The stock ownership requirement

Q51: Coral Corporation declares a nontaxable dividend payable

Q55: A corporation that distributes a property dividend

Q70: Rohan,Inc. ,a calendar year closely held corporation,is

Q71: Rosa Corporation transfers $1 million of its

Q89: In computing consolidated taxable income,capital and §

Q103: What are the advantages of § 6166

Q119: Legislative Regulations are the basis for most