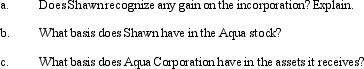

Shawn,a sole proprietor,is engaged in a service business and uses the cash basis of accounting.In the current year,Shawn incorporates his business by forming Aqua Corporation.In exchange for all of its stock,Aqua receives: assets (basis of $380,000 and fair market value of $1.8 million),trade accounts payable of $125,000,and loan due to a bank of $375,000.The proceeds from the bank loan were used by Shawn to provide operating funds for the business.Aqua Corporation assumes all of the liabilities transferred to it.

Definitions:

GDP

Gross Domestic Product, the total value of all goods and services produced within a country in a given period.

Trade Deficit

A situation where a country's imports exceed its exports over a given period, leading to more money leaving the country than coming in.

Mixed Economy

An economic system combining elements of both capitalism and socialism, with some sectors privately owned and others controlled by the government.

Economy

The system by which goods and services are produced, distributed, and consumed within a particular country or region.

Q9: If provided for in the trust agreement,a

Q15: How do the members of a consolidated

Q24: Maroon Company had $150,000 net profit from

Q33: The partial liquidation rules provide a unique

Q43: The divisive "Type D" reorganization requires that

Q52: The so-called "anti-stuffing" rules are designed to

Q52: A shareholder's basis in property received in

Q68: Harry,the sole income beneficiary,received a $40,000 distribution

Q97: ParentCo purchased all of the stock of

Q97: Orange Corporation distributes property worth $300,000,basis of