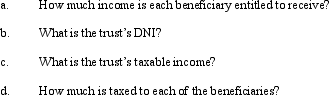

The LMN Trust is a simple trust that correctly uses the calendar year for tax purposes.Its income beneficiaries (Kathie,Lynn,Mark,and Norelle)are entitled to the trust's annual accounting income in shares of one-fourth each.For the current calendar year,the trust has ordinary business income of $30,000,a long-term capital gain of $20,000 (allocable to corpus),and a trustee commission expense of $4,000 (allocable to corpus).Use the format of Figure 20.3 in the text to address the following items.

Definitions:

Turn Of The Century

The transition from one century to the next; often used to specify the period around the 19th to 20th centuries, characterized by significant social and technological changes.

Eccentric

Characterized by unconventional or odd behavior, interests, or habits.

Modern Cities

Urban areas that are characterized by developed infrastructure, technological advancements, and diverse populations.

Walking Cities

Urban areas that were designed or evolved to be navigable primarily by foot, before the widespread use of automobiles.

Q9: Harry and Brenda are husband and wife.Using

Q14: Heron Corporation,a calendar year,accrual basis taxpayer,provides the

Q21: Maria and Christopher each own 50% of

Q32: As to property received as a gift,a

Q54: Rachel owns an insurance policy on the

Q55: Fender Corporation was organized in 2008 and

Q70: If a shareholder owns stock received as

Q74: A taxpayer should conduct a cost-benefit analysis

Q116: What is a simple trust? A complex

Q124: Sam and Lucinda are husband and wife