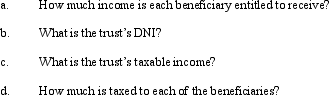

The LMN Trust is a simple trust that correctly uses the calendar year for tax purposes.Its income beneficiaries (Kathie,Lynn,Mark,and Norelle)are entitled to the trust's annual accounting income in shares of one-fourth each.For the current calendar year,the trust has ordinary business income of $30,000,a long-term capital gain of $20,000 (allocable to income),and a trustee commission expense of $4,000 (allocable to corpus).Use the format of Figure 20.3 in the text to address the following items.

Definitions:

Broader Activity

A term that can refer to a wide range of actions or initiatives within a company or organization, stretching beyond its core or routine operations.

Decentralized Divisions

A corporate structure where decision-making and operations are distributed among semi-autonomous units or departments within the organization.

Comprehensive Image

An extensive or complete representation or perception of an object, person, or concept, capturing all its aspects and attributes.

Profitability

A measure of how much profit a company generates compared to its revenues.

Q20: Homer and Laura are husband and wife.At

Q37: What is meant by the term "distributable

Q38: Macayo,Inc. ,received $800,000 life insurance proceeds on

Q52: Which of the following items will be

Q64: Any loss in current E & P

Q78: Copper Corporation owns stock in Bronze Corporation

Q81: Gloria,a calendar year taxpayer subject to a

Q82: Canary Corporation has 1,000 shares of stock

Q94: Bob is one of the income beneficiaries

Q96: At the time of her death in