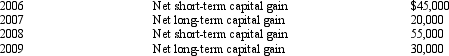

Bear Corporation has a net short-term capital gain of $35,000 and a net long-term capital loss of $200,000 during 2010.Bear Corporation has taxable income from other sources of $600,000.Prior years' transactions included the following:

Compute the amount of Bear's capital loss carryover to 2011.

Definitions:

Controversy

A prolonged public disagreement or heated discussion, often involving differing opinions on a particular matter.

Franchising

A method of conducting business where a franchisor licenses trademarks and proven methods of doing business to a franchisee in exchange for a recurring payment, and usually a percentage of gross sales or gross profits.

Market Analysis

The study of the market within an industry, including the analysis of supply and demand, target demographic, and competition.

Franchise

A type of license that grants a franchisee access to a franchisor's proprietary knowledge, processes, and trademarks, allowing them to sell a product or service under the franchisor's business model.

Q3: Matt and Hillary are husband and wife

Q12: There is no Federal income tax assessed

Q18: Typically exempt from the sales/use tax base

Q30: The domestic production activities deduction is limited

Q55: List the three major functions of distributable

Q61: The Federal gift and estate taxes were

Q66: What are some of the pitfalls in

Q81: Chev Corporation,a calendar year corporation,has alternative minimum

Q85: At the time of her death in

Q93: Ira,a calendar year taxpayer,purchases as an investment