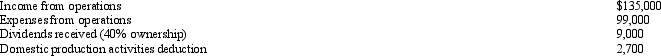

During the current year,Kingbird Corporation (a calendar year C corporation) had the following income and expenses:

On October 1,Kingbird Corporation made a contribution to a qualified charitable organization of $6,300 in cash (not included in any of the above items) .Determine Kingbird's charitable contribution deduction for the current year.

Definitions:

Assessment Techniques

Various methods and tools used to evaluate and measure individuals' abilities, skills, behavior, and personality.

IQ Tests

Standardized exams designed to measure human intelligence and cognitive abilities in relation to an age group.

Dream Analysis

A therapeutic technique used in psychoanalysis to interpret the content of dreams in order to uncover underlying thoughts and feelings.

Jungian Concepts

A set of psychological theories developed by Carl Jung, including ideas like the collective unconscious, archetypes, individuation, and the personas we present to the world.

Q14: The typical local property tax falls on

Q20: The bona fide business requirement of §

Q40: Sam's gross estate includes stock in Tern

Q48: Jack and Heidi are husband and wife

Q70: Nicole owns and operates a sole proprietorship.She

Q77: An estate's beneficiary generally must wait until

Q79: Which AMT adjustment would only be negative?<br>A)Loss

Q82: In 1998,Katelyn inherited considerable property when her

Q83: The receipt of nonqualified preferred stock in

Q83: What is the rationale for the deferral