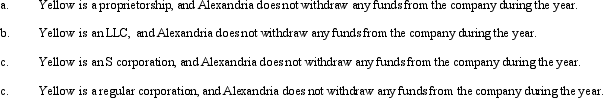

During the current year,Yellow Company had operating income of $380,000 and operating expenses of $300,000.In addition,Yellow had a long-term capital loss of $50,000.Based on this information,how does Alexandria,the sole owner of Yellow Company,report this information on her individual income tax return under following assumptions?

Definitions:

Howard Winant

A notable sociologist recognized for his contributions to the understanding of race and racism in contemporary society.

White Ethnics

White Ethnics refers to white individuals who identify with a specific ethnic group that is not considered the majority or dominant group in a particular society, often highlighting heritage from European countries.

Interracial Marriage

A marriage between partners who belong to different races or racialized ethnicities.

Racial Identification

The process by which individuals associate themselves with a particular racial group, often based on shared cultural, physical, or genetic characteristics.

Q10: Lydia wants to donate a parcel of

Q46: Trusts typically use a calendar tax year.

Q49: AMTI may be defined as regular taxable

Q50: Quail Corporation is a C corporation with

Q69: To prove successful in freezing the value

Q71: On January 1,Cotton Candy Corporation (a calendar

Q77: Faye,a CPA,is preparing Judith's tax return.One item

Q91: Doyle died in 2000 and by will

Q108: In arriving at the value of stock

Q119: The election by an estate of §