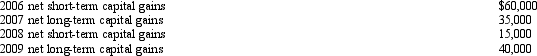

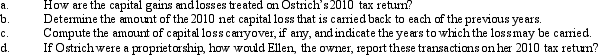

Ostrich,a C corporation,has a net short-term capital gain of $40,000 and a net long-term capital loss of $180,000 during 2010.Ostrich also has taxable income from other sources of $1 million.Prior years' transactions included the following:

Definitions:

Ethernet

A technology for connecting devices in a wired local area network (LAN) enabling the transmission of data over a physical cable.

LAN Protocol

A set of rules and standards used for communication within a Local Area Network to ensure the smooth transmission of data.

SMTP

Simple Mail Transfer Protocol (SMTP) is a protocol used for sending emails across the Internet.

Formulated Messages

Predefined or carefully crafted messages designed to communicate specific information, guidance, or instructions in a clear and effective manner.

Q2: Once the distributable net income (DNI)of a

Q5: In January 2009,Clint makes a gift of

Q14: Why should the tax practitioner study the

Q38: List several current initiatives that the IRS

Q41: Andrew,a process engineer for an oil company,inherited

Q49: AMTI may be defined as regular taxable

Q57: Starling Corporation,a closely held personal service corporation,has

Q63: Al creates a trust,income payable to John

Q87: Under his grandfather's will,Tad is entitled to

Q88: A capital stock tax usually is structured