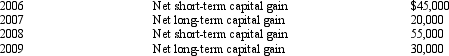

Bear Corporation has a net short-term capital gain of $35,000 and a net long-term capital loss of $200,000 during 2010.Bear Corporation has taxable income from other sources of $600,000.Prior years' transactions included the following:

Compute the amount of Bear's capital loss carryover to 2011.

Definitions:

Factors

Numbers or expressions that divide into another number or expression exactly, without leaving a remainder.

Nearest Hundredth

A method of rounding numbers so that they are accurate to two decimal places.

Decimal Place

A position of a number to the right of the decimal point, indicating fractions of 10.

Square Root

The value that, when multiplied by itself, gives the original number, used in mathematics to find an original value.

Q8: A personal service corporation with taxable income

Q25: When a tax issue is taken to

Q42: During 2010,Sparrow Corporation,a calendar year C corporation,had

Q44: Circular 230 prohibits a tax preparer from

Q48: In the year in which an estate

Q57: Distributions from retirement plans and proceeds from

Q63: Basis of appreciated property transferred minus boot

Q75: Which of the following procedures carried out

Q83: The receipt of nonqualified preferred stock in

Q108: Orange Corporation owns stock in White Corporation