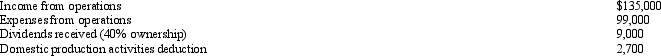

During the current year,Kingbird Corporation (a calendar year C corporation) had the following income and expenses:

On October 1,Kingbird Corporation made a contribution to a qualified charitable organization of $6,300 in cash (not included in any of the above items) .Determine Kingbird's charitable contribution deduction for the current year.

Definitions:

Face Card

A playing card that depicts a person with royal or social significance, including kings, queens, and jacks in a standard deck of cards.

Standard Deck

A deck of 52 playing cards, consisting of four suits: hearts, diamonds, clubs, and spades, each suit containing 13 cards from Ace to King.

Spade

A tool with a broad, flat blade, typically used for digging or cutting earth.

Standard Deck

Refers to a complete set of playing cards typically consisting of 52 cards, divided into four suits: hearts, diamonds, clubs, and spades.

Q6: Under proper circumstances,a disclaimer by an heir

Q18: When DNI includes exempt interest income,the beneficiary

Q26: Goose Corporation makes a property distribution to

Q36: On January 1,Gull Corporation (a calendar year

Q41: Recently,the overall Federal income tax audit rate

Q42: Reasonable needs for purposes of the accumulated

Q62: In connection with a traditional IRA that

Q72: Cash distributions received from a corporation with

Q87: Debbie,a calendar year taxpayer,did not file a

Q101: Red Corporation,which owns stock in Blue Corporation,had