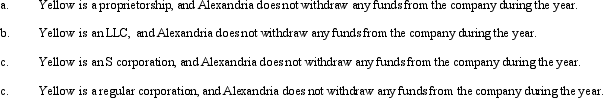

During the current year,Yellow Company had operating income of $380,000 and operating expenses of $300,000.In addition,Yellow had a long-term capital loss of $50,000.Based on this information,how does Alexandria,the sole owner of Yellow Company,report this information on her individual income tax return under following assumptions?

Definitions:

Q13: A taxpayer wishing to reduce the negative

Q16: Falcon Corporation has $200,000 of current E

Q21: To close perceived tax loopholes,Congress enacted two

Q24: Red Corporation,a calendar year taxpayer,has taxable income

Q31: With respect to a trust,the terms creator,donor,and

Q31: In the case of an individual,modified AGI

Q96: At the time of her death in

Q101: The Chief Counsel of the IRS is

Q101: One-third of the Hermann Estate's distributable net

Q126: Which,if any,of the following statements correctly reflects