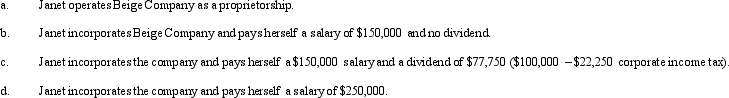

Beige Company has approximately $250,000 in net income in 2010 before deducting any compensation or other payment to its sole owner,Janet (who is single).Assume that Janet is in the 35% marginal tax bracket.Discuss the tax aspects of each of the following arrangements.(Ignore any employment tax considerations. )

Definitions:

Damages

Monetary compensation awarded by a court to a person who has suffered loss or harm due to the wrongful act of another.

Expenses Incurred

Costs that have been recognized or are payable due to business activities or transactions.

Breach Of Contract

The violation of any of the agreed-upon terms and conditions of a binding contract.

Special Damages

Compensatory damages that cover specific, quantifiable financial losses suffered by a plaintiff, such as medical bills or lost wages, due to the defendant's wrongdoing.

Q8: In satisfying the more-than-35% test for qualification

Q12: During the current year,Gander Corporation sold equipment

Q20: Which statement appearing below does not correctly

Q38: Macayo,Inc. ,received $800,000 life insurance proceeds on

Q41: A state cannot levy a tax on

Q56: Brad and Heather are husband and wife

Q62: Ann,Irene,and Bob incorporate their respective businesses and

Q70: If stock rights are taxable,the recipient has

Q96: The trust instrument provides that Tamara,the sole

Q129: Which,if any,of the following is a correct