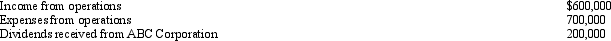

During the current year,Quartz Corporation (a calendar year C corporation)has the following transactions:

Quartz owns 25% of ABC Corporation's stock.How much is Quartz Corporation's taxable income (loss)for the year?

Definitions:

Kingpin

A central pivot in the steering mechanism of a vehicle, around which the steerable wheels pivot.

Locking Mechanism

A device or system used to prevent movement or unauthorized access by securing components in a fixed or immobile position.

Fontaine No-Slack

A brand-specific technology applied to fifth wheel couplings, designed to minimize slack and improve connection reliability between tractor and trailer.

Q11: The rules used to determine the taxability

Q11: Black Corporation,an accrual basis taxpayer,was formed and

Q50: Maize Corporation has average gross receipts of

Q52: Gold Corporation,a calendar year cash basis taxpayer,made

Q60: The Rodriguez Trust generated $200,000 in alternative

Q64: If depreciable property is transferred by gift,any

Q80: A letter ruling is issued by the

Q81: All dividends received by individual shareholders are

Q103: Maize Corporation had $200,000 operating income and

Q106: The IRS does not consider property settlements