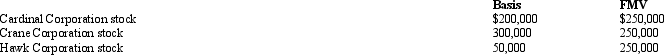

Eric,age 80,has accumulated about $4 million in net assets.Among his assets are the following marketable securities held as investments.

Eric would like to donate (either by lifetime or testamentary transfer) $250,000 in value to his church.In addition,to consummate a land deal,he needs $250,000 in cash.Looking solely to tax considerations and using only the assets described above,Eric's best choice is to:

Definitions:

McClelland

A psychologist known for his work on motivation, particularly the Theory of Needs focusing on achievement, power, and affiliation.

Achievement Motivation

The inner drive or need to attain a goal or reach a particular standard of success.

Expectancy Model

The expectancy model, often applied in motivational theory, posits that an individual's motivation is determined by their expected outcomes of specific behaviors or efforts.

Assumptions

Beliefs or ideas taken for granted without verification, often underlying decision-making processes and perspectives.

Q26: In connection with the taxpayer penalty for

Q46: The domestic production activities deduction is intended

Q53: At the time of her death,Hailey was

Q63: Al creates a trust,income payable to John

Q72: The AMT rate for corporations is the

Q80: Generally,capital gains are allocated to fiduciary corpus,because

Q96: The special tax penalty imposed on appraisers:<br>A)Applies

Q103: A corporate payment that qualifies as a

Q111: Determine the tax effects of the indicated

Q114: In an estate freeze,the preferred stock is