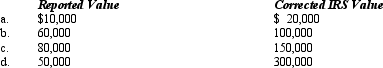

Compute the undervaluation penalty for each of the following independent cases involving the executor's reporting of the value of a closely held business in the decedent's gross estate.In each case,assume a marginal estate tax rate of 45%.

Definitions:

Continuing Behavior

Persistent actions or activities that an individual keeps doing over a period of time.

Cognitive Dissonance

A psychological phenomenon where an individual experiences discomfort due to conflicting beliefs, attitudes, or behaviors.

Coaction Effects

The impact on performance of the presence of other people engaged in the same task.

Source Confusion

Source Confusion is a memory error where individuals are unable to recall the true source of a memory, leading to misattribution of the information's origin.

Q1: Becky made taxable gifts in 1974,1986,and 2009.In

Q21: Amelia,Inc. ,is a domestic corporation with the

Q24: In each of the following independent situations,describe

Q32: How do rulings issued by the IRS

Q33: In multistate income taxation,the sales factor applies

Q44: The excise tax imposed on a private

Q57: An S corporation election for Federal income

Q61: A C corporation offers greater flexibility in

Q75: Norma formed Hyacinth Enterprises,a proprietorship,in 2010.In its

Q141: As reflected by the tax law,Congressional policy