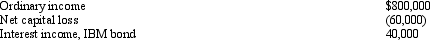

You are completing the State A income tax return for Quaint Company.Quaint is a limited liability company,and it operates in various states,showing the following results.

In A,all interest is treated as business income.A uses a sales-only apportionment factor.Assuming the following data are correct,compute Quaint's A taxable income.

Definitions:

MARS Model

A framework identifying four critical factors—Motivation, Ability, Role perceptions, and Situational factors—that determine individual behavior and results at work.

Motivation

The reasons or driving forces behind individuals' actions and behavior, which can be intrinsic or extrinsic.

Role Perceptions

The understanding an individual has about their job duties, responsibilities, and expectations within an organization.

Collectivist

Pertaining to cultures or societies that prioritize group goals over individual ones, emphasizing community, cooperation, and interdependence.

Q7: An exempt organization can be subject to

Q8: At the time of her death on

Q27: The use of the election to split

Q37: An S corporation's AAA cannot have a

Q41: The alternative minimum tax applies to an

Q43: Which of the following statements correctly reflects

Q48: How can an exempt organization,otherwise classified as

Q50: Which of the following business entity forms

Q60: Leonard inherits a traditional IRA from his

Q96: List the various ways to minimize or