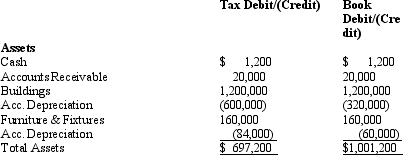

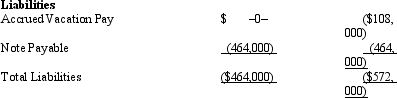

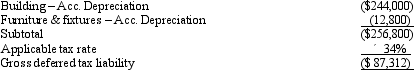

Amelia,Inc. ,is a domestic corporation with the following balance sheet for book and tax purposes at the end of the year.Assume a 34% corporate tax rate and no valuation allowance.

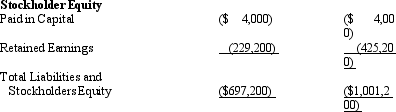

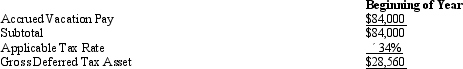

Amelia Inc.'s gross deferred tax assets and liabilities at the beginning of Amelia's year are listed below.

Amelia Inc.'s book income before tax is $25,200.Amelia has two permanent differences between book and taxable income.It earned $1,000 in tax exempt municipal bond interest and had $1,840 in nondeductible meals and entertainment expense.Provide the income tax footnote rate reconciliation for Amelia.

Definitions:

Environmental Scanning

The process businesses use to understand the external factors influencing their operation, including technological, regulatory, and competitive elements.

Internal Factors

Elements or conditions within an organization or individual's control that can influence decisions, behaviors, and outcomes, such as policies, resources, and personal abilities.

Systematic Monitoring

A structured and continuous process of tracking and evaluating the performance, quality, or progress of a project, system, or organization.

Cultural Audits

Audits of the culture and quality of work life in an organization

Q28: In the current year,Greg formed an equal

Q37: Morgan and Kristen formed an equal partnership

Q42: The Schedule M-3 is the same for

Q52: The tax treatment of S corporation shareholders

Q54: Amelia,Inc. ,is a domestic corporation with the

Q54: An S corporation does not recognize a

Q77: Which,if any,of the following items is subject

Q78: The December 31,2010,balance sheet of the DIP

Q90: A church is not required to obtain

Q130: An exempt organization that otherwise would be