Multiple Choice

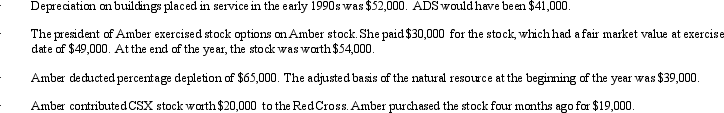

Amber,Inc. ,has taxable income of $212,000.In addition,Amber accumulates the following information which may affect its AMT.

What is Amber's AMTI?

Definitions:

Related Questions

Q11: ASC 740 (FIN 48)allows companies to choose

Q12: Latrelle prepares the tax return for Whitehall

Q28: In the current year,Greg formed an equal

Q32: Suzy owns a 25% capital and profits

Q66: On January 2,2009,David loans his S corporation

Q68: In a liquidating distribution,a partnership must distribute

Q68: Which equity arrangement would stop a corporation

Q78: West,Inc. ,is a domestic corporation.It owns 100%

Q78: If an organization qualifies for exempt status

Q123: A limited liability company (LLC)is a hybrid