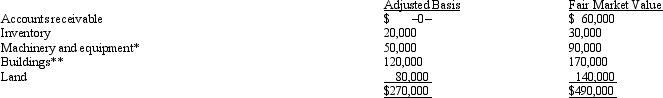

Albert's sole proprietorship owns the following assets:

* Potential § 1245 recapture of $45,000.

** Straight-line depreciation was used.

Albert sells his sole proprietorship for $500,000.Calculate Albert's recognized gain or loss and classify it as capital or ordinary.

Definitions:

Skiing Accident

An unexpected and undesirable event occurring during skiing, leading to injury or damage.

Geographic Segmentation

The process of dividing a market into different geographical units like regions, countries, states, or cities.

United Talent Agency

A leading talent and entertainment company that represents artists, athletes, content creators, and other professionals in the entertainment industry.

Trace Adkins

A country music singer and actor known for his bass-baritone voice and numerous hits within the country genre.

Q5: A partnership is required to make a

Q16: Maria and Miguel Blanco are in the

Q18: Rex and Scott operate a law practice

Q23: Simone is a calendar year cash basis

Q28: Stare decisis applies to Small Cases Division

Q38: Revenue-neutral tax laws reduce deficits.

Q44: The excise tax imposed on a private

Q51: Which statement is false?<br>A)An S corporation is

Q53: When the taxpayer operates in one or

Q61: Sharon and Sara are equal partners in