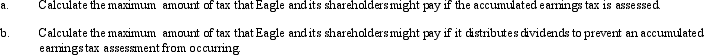

Eagle,Inc.recognizes that it may have an accumulated earnings tax problem.According to its calculation,Eagle anticipates it has accumulated taxable income,before reduction for dividends paid,of $600,000 in 2010.Assume that its shareholders are in the 35% marginal tax bracket.

Definitions:

Annually

Occurring once every year, often used to describe financial operations or events that happen yearly.

Interest

The cost of borrowing money, typically expressed as an annual percentage of the loan amount.

Coupon Rate

The annual interest rate paid by bond issuers to its bondholders, usually expressed as a percentage of the bond's face value.

Q17: Determine the incorrect citation:<br>A)Ltr.Rul.20012305.<br>B)George W.Guill,112 T.C._,No.22 (1999).<br>C)Ltr.Rul.200108052.<br>D)Rev.Rul,98-32,I.R.B.No.25,4.<br>E)None

Q20: An activity is not an unrelated trade

Q31: Concerning the penalty for civil fraud applicable

Q40: Rose,Inc. ,a qualifying § 501(c)(3)organization,incurs lobbying expenditures

Q44: In most states,a taxpayer's income is apportioned

Q48: Which transaction affects the Other Adjustments Account

Q49: Jenny prepared Steve's income tax returns for

Q57: Which of the following exempt organizations are

Q59: Pat is a 40% member of the

Q86: Hermann Corporation is based in State A