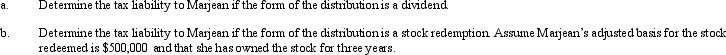

Swallow,Inc. ,is going to make a distribution of $900,000 to Marjean who is in the 35% tax bracket.

Definitions:

Current Liabilities

Short-term financial obligations due within one year or within the company's operating cycle.

Depreciation

Depreciation represents the gradual reduction of the recorded cost of a fixed asset over its useful life, reflecting the asset's wear and tear, deterioration, or obsolescence.

After-Tax Income

The amount of income left after all applicable taxes have been deducted, reflecting the net income available for spending, saving, or investment.

Net Income

The total earnings of a company after all expenses and taxes have been deducted from revenue.

Q3: Gator,Inc. ,is a domestic corporation with the

Q7: In which of the following independent situations

Q22: A limited partnership can indirectly avoid unlimited

Q46: Marianne is a 50% partner in the

Q53: On December 31 of last year,Pat gave

Q54: An S corporation does not recognize a

Q55: Lott Corporation in Macon,Georgia converts to S

Q59: Kurt Corporation realized $600,000 taxable income from

Q74: Maggie,a partner in the Magpie partnership,received a

Q76: Theater,Inc. ,an exempt organization,owns a printing company,Printers,Inc.