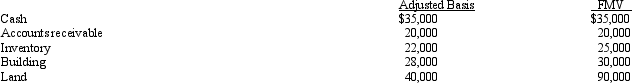

Lee owns all the stock of Vireo,Inc. ,a C corporation for which he has an adjusted basis of $150,000.The assets of Vireo,Inc. ,are as follows:

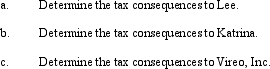

Lee sells his stock to Katrina for $200,000.

Definitions:

Total Costs

The sum of all expenses (fixed and variable) incurred in the production of goods or services.

Long-Run Total Cost

The total cost incurred by a firm when all inputs, including both fixed and variable costs, are fully adjustable.

Long-Run Supply Function

A relationship that shows the quantity of goods a firm is willing and able to produce and supply to the market at different possible prices over a long period, considering all inputs as variable.

Factor Prices

The amounts paid to the factors of production, such as wages for labor, rent for land, and profit for capital.

Q3: Which of the following statements is correct?<br>A)Exempt

Q14: The typical local property tax falls on

Q20: The benefits of a passive investment company

Q28: Last year,Oscar contributed nondepreciable property with a

Q32: The deduction for charitable contributions can be

Q52: Taxpayers may look at Committee Reports to

Q53: All tax preference items flow through the

Q57: For purposes of determining gain on a

Q79: Temporary differences cause differences in the hypothetical

Q94: Which,if any,of the following can be eligible