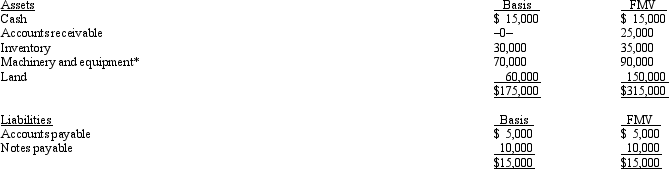

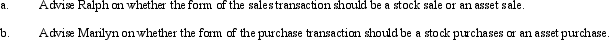

Ralph owns all the stock of Silver,Inc. ,a C corporation for which his adjusted basis is $225,000.Ralph founded Silver 12 years ago.The assets and liabilities of Silver are as follows:

*Accumulated depreciation of $55,000 has been deducted.

Ralph and the purchaser,Marilyn,have agreed to a purchase price of $350,000 less any outstanding liabilities.They are both in the 35% tax bracket,and Silver is in the 34% tax bracket.

Definitions:

Routine Hassles

Everyday problems or irritations that can contribute to stress.

Mental Health

A state of well-being in which an individual realizes their own abilities, can cope with the normal stresses of life, work productively, and is able to make contributions to their community.

Physical Health

A state of well-being in which an individual is able to perform daily activities without restrictions caused by physical illness or injury.

Secondary Appraisal

An evaluation of one’s coping resources and options for dealing with stress.

Q3: Gator,Inc. ,is a domestic corporation with the

Q20: An item that appears in the "Other

Q33: Which of the following taxes are included

Q38: Crew Corporation elects S status effective for

Q51: Federal agencies exempt from Federal income tax

Q77: The sales/use tax that is employed by

Q92: Which of the following statements regarding intermediate

Q96: The special tax penalty imposed on appraisers:<br>A)Applies

Q101: Samantha owned 1,000 shares in Evita,Inc. ,an

Q127: Brenda contributes appreciated property to her business