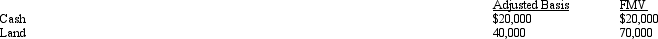

Julie is going to contribute the following assets to a business entity in exchange for an ownership interest.

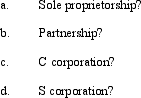

What are the tax consequences of the contribution to Julie if the business entity is a(n):

Definitions:

Latent

Existing but not yet developed or manifest; hidden or concealed.

Skills

The ability to do something well, often as a result of knowledge, practice, and aptitude.

Learning

The acquisition of knowledge or skills through experience, study, or by being taught, which leads to a change in behavior or understanding.

Bandura

Refers to Albert Bandura, a psychologist known for his work on social learning theory, emphasizing the role of observational learning, imitation, and modeling.

Q1: The Project of Human Development utilized an

Q2: Robin Company has $100,000 of income before

Q16: Quantitative research is of a higher order

Q19: Repatriating prior year earnings from a foreign

Q55: Lott Corporation in Macon,Georgia converts to S

Q62: For a new corporation,a premature S election

Q76: Henry contributes property valued at $60,000 (basis

Q83: The excise tax that is imposed on

Q86: "Abstract tags put on reality" is a

Q88: Data gathering is the first step in