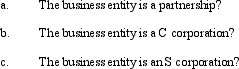

Gladys contributes land with an adjusted basis of $85,000 and a fair market value of $100,000 to a business entity in which she is an 80% owner on the first day of the tax year.Discuss the tax consequences to Gladys if the business entity sells the land six months later for $120,000 if:

Definitions:

Moving Train

A dynamic system or process in motion, often used metaphorically to describe something that is progressing or evolving.

Opposite Direction

Moving or pointing away from each other in a contrasting or reverse course.

Window View

The scenery or outlook seen through a window.

Involuntary Twitch

A sudden, uncontrolled small muscle movement or contraction, often occurring without a person's conscious command.

Q1: With respect to the audit process,which of

Q2: Which of the following is usually the

Q31: Devon owns 30% of the Agate Company

Q31: Induction is a process of moving from

Q38: If a valuation allowance is increased in

Q38: Crew Corporation elects S status effective for

Q55: Harry and Sally are considering forming a

Q57: Which of the following exempt organizations are

Q81: Under what circumstances are bingo games not

Q90: State and local politicians tend to apply