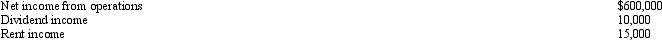

Tuna,Inc. ,a closely held corporation which is not a PSC,owns a 40% interest in Trout Partnership,which is classified as a passive activity.Trout's taxable loss for the current year is $200,000.During the year,Tuna receives a $60,000 cash distribution from Trout.Other relevant data for Tuna are as follows:

How much of Tuna's share of Trout's loss may it deduct in calculating its taxable income?

Definitions:

Labour Rate Variance

The difference between the actual labor costs incurred and the standard labor costs for the actual production level.

Actual Rate

The actual cost incurred or the price paid for materials, labor, or overhead as opposed to budgeted or standard costs.

Standard Rate

A predetermined cost that is often used in budgeting and costing exercises to estimate the expected rate for services or products.

Direct Labour

The cost associated with employees who are directly involved in the production process.

Q3: Gator,Inc. ,is a domestic corporation with the

Q6: Define a qualified corporate sponsorship payment.

Q15: The penalty for substantial understatement of tax

Q18: Certain exempt organizations can engage in lobbying

Q33: Which of the following taxes are included

Q34: A city might assess a professional occupation

Q59: Gladys contributes land with an adjusted basis

Q59: Links,Inc. ,an exempt organization whose mission is

Q89: Martinson later retracted his "nothing works" critique

Q92: The § 465 at-risk provision and the