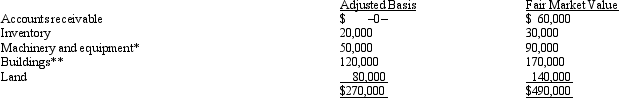

Kristine owns all of the stock of a C corporation which owns the following assets:

* Potential § 1245 recapture of $45,000.

** Straight-line depreciation was used.

Her adjusted basis for her stock is $270,000.Calculate Kristine's recognized gain or loss and classify it as capital or ordinary if she sells her stock for $500,000.

Definitions:

White Blood Cell

Cells of the immune system involved in defending the body against both infectious disease and foreign materials.

Differential White Blood Cell Count

A test that measures the percentages of different types of white blood cells in the blood, used to diagnose and monitor diseases.

Lymphocytes

A type of white blood cell integral to the immune system, with roles in adaptive immunity, including B cells and T cells.

Parasitic Worm Infection

An infestation by helminths, a group of parasitic worms, that can cause disease and malnutrition in humans.

Q25: A trade or business that is operated

Q30: Which statement is incorrect with respect to

Q45: A distribution from a partnership to a

Q50: Cindy is a 5% limited partner in

Q79: The property factor includes real property and

Q86: Where the S corporation rules are silent,partnership

Q97: An LLC apportions and allocates its annual

Q101: Samantha owned 1,000 shares in Evita,Inc. ,an

Q109: Maurice purchases a bakery from Philip for

Q114: You are a 60% owner of an