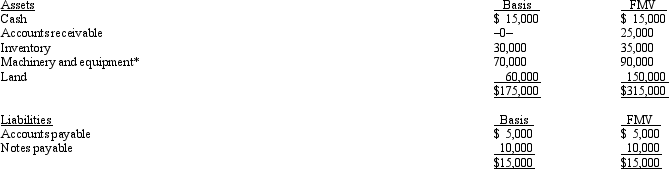

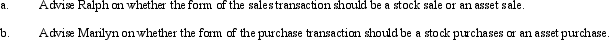

Ralph owns all the stock of Silver,Inc. ,a C corporation for which his adjusted basis is $225,000.Ralph founded Silver 12 years ago.The assets and liabilities of Silver are as follows:

*Accumulated depreciation of $55,000 has been deducted.

Ralph and the purchaser,Marilyn,have agreed to a purchase price of $350,000 less any outstanding liabilities.They are both in the 35% tax bracket,and Silver is in the 34% tax bracket.

Definitions:

Ego Integrity

A term from Erikson's psychosocial development theory, referring to the sense of coherence and fulfillment one feels when looking back on their life, typically in old age.

General Practice Physician

A medical doctor who diagnoses and treats a wide range of common illnesses and conditions, providing continuous, comprehensive health care for individuals and families.

Community Outreach

Efforts or programs designed to engage and provide services or support to the broader community.

Self-concept

An individual's perception of themselves, encompassing beliefs, feelings, and thoughts about one’s identity and capabilities.

Q7: Douglas and Sue,related parties,are landlord and tenant

Q11: Purple Ltd. ,a calendar year taxpayer,had the

Q21: What impact has the community property system

Q28: Form 1120S provides a shareholder's computation of

Q41: Gator,Inc. ,is a domestic corporation with the

Q44: Surina sells her 25% partnership interest to

Q51: Federal agencies exempt from Federal income tax

Q80: Partner Bob purchased his partnership interest for

Q82: For income tax purposes,proportionate and disproportionate distributions

Q97: An LLC apportions and allocates its annual