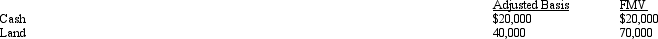

Julie is going to contribute the following assets to a business entity in exchange for an ownership interest.

What are the tax consequences of the contribution to Julie if the business entity is a(n):

Definitions:

European Options

Financial derivatives that give the holder the right, but not the obligation, to buy or sell an asset at a specified price on a specified expiration date, unlike American options, which can be exercised at any time before expiry.

Pricing Model

A method or algorithm used to determine the selling price of a product or service, taking into account costs, market conditions, and profit margins.

Standard Deviation

A statistical measure of the dispersion or variance in a set of data points, widely used to assess the risk associated with a financial asset's return.

Call Option

A financial contract that gives the option buyer the right, but not the obligation, to buy a specified quantity of an asset at a set price within a specific time frame.

Q9: Blue,Inc. ,receives its support from the following

Q21: The use tax is designed to complement

Q22: Holly and Marcus formed a partnership.Holly received

Q26: If an exempt organization is subject to

Q29: How can double taxation be avoided or

Q44: The excise tax imposed on a private

Q59: Links,Inc. ,an exempt organization whose mission is

Q67: With respect to the Small Cases Division

Q71: Which of the following are consequences of

Q84: With respect to the audit process,which statement