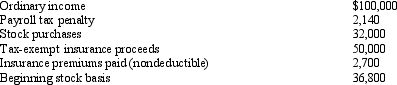

You are given the following facts about a one-shareholder S corporation,and you are asked to prepare the shareholder's ending stock basis.

Definitions:

Benefit

An advantage or profit gained from something.

Constructive Delivery

A symbolic delivery that confers the right to take possession of property that cannot be physically delivered.

Exclusive Possession

The right of a tenant or lessee to use and control a property without interference from the landlord or lessor.

Bailed Property

Items in the possession of someone who is not their owner, under a temporary agreement, awaiting its return or fulfillment of a condition.

Q8: Lime,Inc. ,has taxable income of $330,000.If Lime

Q11: Bobby and Sally work for the same

Q32: The LIFO recapture tax is a variation

Q43: Passive investment income includes gains from the

Q50: Identify the components of the tax model

Q52: ASC 740 (FIN 48)replaced FAS 5,Accounting for

Q53: On December 31 of last year,Pat gave

Q54: In calculating unrelated business taxable income,the exempt

Q77: Normally a distribution of property from a

Q85: Brew,an S corporation,has gross receipts of $190,000